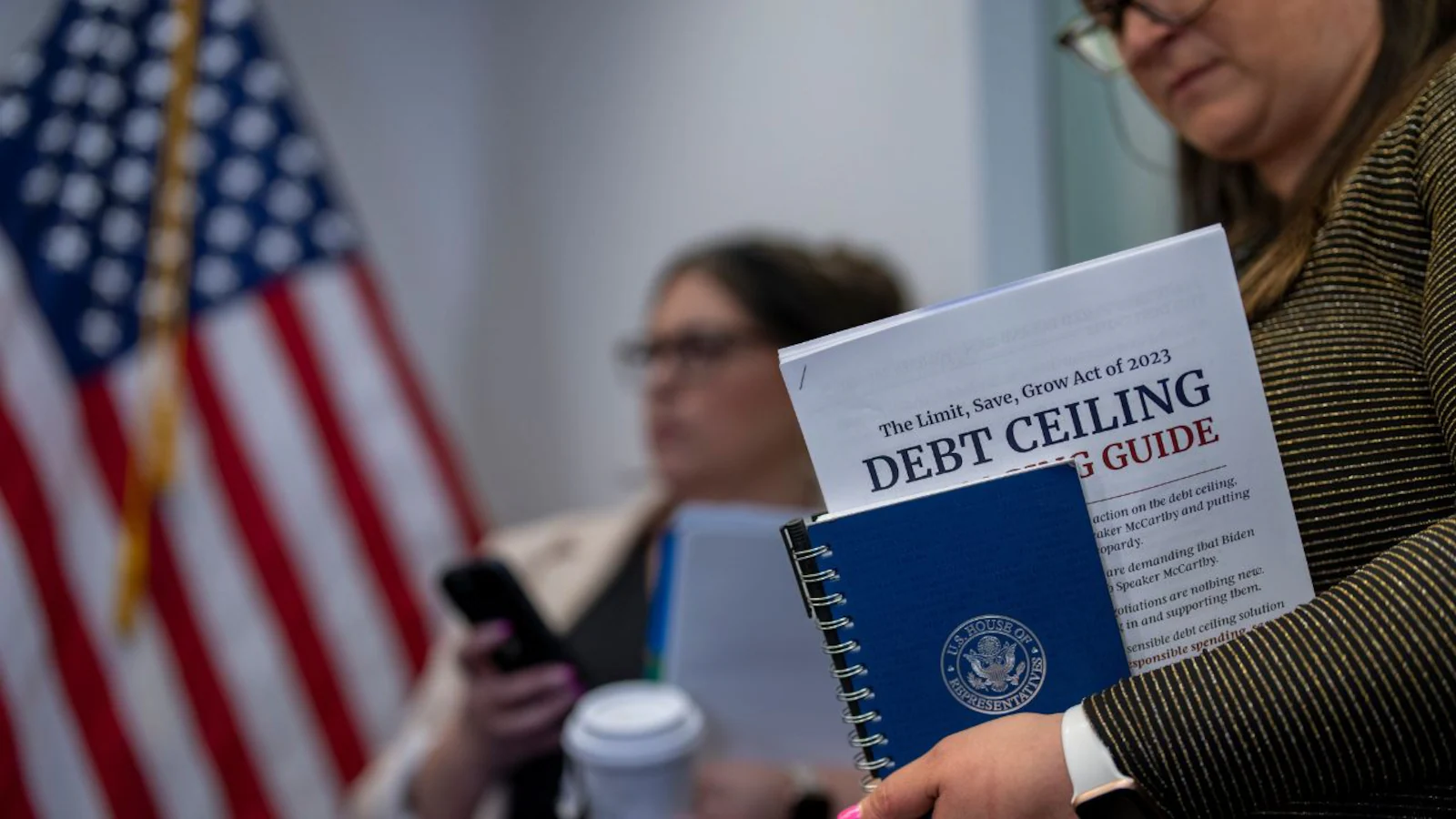

Debt ceiling or the debt limit implies to the statutory limit on the amount of debt the U.S. Treasury can have outstanding in order to pay for the government’s obligations, bills, as well as past expenses that Congress has already approved. Kavan Choksi / カヴァン・チョクシ underlines that the debt ceiling is not an authorization for future spending. The United States may eventually default on its debt and obligations without a congressional increase in the debt limit. This is an unprecedented event that is quite likely to have a serious impact on global markets and economies.

Kavan Choksi / カヴァン・チョクシ provides an introduction to the United States debt ceiling

The debt limit refers to a ceiling imposed by Congress in 1917 that sets the maximum amount of outstanding debt the U.S. can incur. The very first debt limit was established in order to provide autonomy to the Treasury over borrowing by enabling it to issue debt up to the ceiling without congressional approval. This made it easier to finance mobilization efforts in World War I. Prior to that, Congress typically had to authorize the Treasury to borrow in smaller increments.

With time, the United States got involved in more wars abroad and hence began to accumulate more debts. Subsequent to entering the World War II, the United States raised the debt limit every year to accommodate increased borrowing. As war costs began to dissipate and the federal government started to run three years of surpluses, by the end of the war, in June 1946, the debt limit was lowered to $275 billion. The federal debt limit then stayed unchanged at this level for eight consecutive years, which was the longest such period since its inception. Over the last two decades or so, the United States has added $25 trillion in debt. Every year since 2001, the country has been spending almost $1 trillion more than it receives in taxes and other revenue. A large part of this is due to financing emergency responses, tax cuts, financing wars, and expanded federal spending. In order to make up for the difference, the government has to borrow funds that would enable it to continue to finance payments that Congress has already authorized. When the U.S. hits its debt ceiling, unless Congress raises or suspends the debt limit, the federal government will lack the cash to pay all its obligations.

Since 1960, Congress has adjusted the debt limit 78 times, with 49 of these adjustments occurring under Republican presidents and 29 under Democratic presidents, as reported by the Department of Treasury. Kavan Choksi / カヴァン・チョクシ mentions that on each occasion, Congress acted to prevent a national default. However, in recent years, increasing the debt limit has become more politically contentious, particularly when control in Washington is divided. Both parties have used the debt ceiling vote, one of the few mandatory bills, to make political statements and seek concessions, while accusing each other of excessive spending

+ There are no comments

Add yours